DI supported a global motorbike company in Southeast Asia

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

DI supported a global consumer finance company in Vietnam

• Client: a global consumer finance company

• Country: Vietnam

• Industry: Financial Services

Background:

A client exploring the auto-lending market in Vietnam faced a significant challenge: the absence of a reliable credit rating system, which prolonged screening processes and increased the risk of ineffective decision-making. These inefficiencies created barriers to market growth and constrained the ability of lenders to extend loans confidently.

To address this gap, the client engaged DI to assess the existing lending ecosystem and develop a market strategy to launch a new auto-lending business. The project aimed to identify the key challenges in the lending process, conceptualize innovative value offerings, and design a business model that balanced operational feasibility with market readiness. Recognizing the importance of collaboration, the client sought to build a scalable business through partnerships with local banks, leveraging their networks and infrastructure to create a trustable and efficient lending framework. DI’s insights were critical for shaping the strategy and enabling a successful market entry.

Support overview:

DI’s scope of work focused on addressing the systemic inefficiencies in Vietnam’s auto-lending market and crafting a practical market strategy for the client.

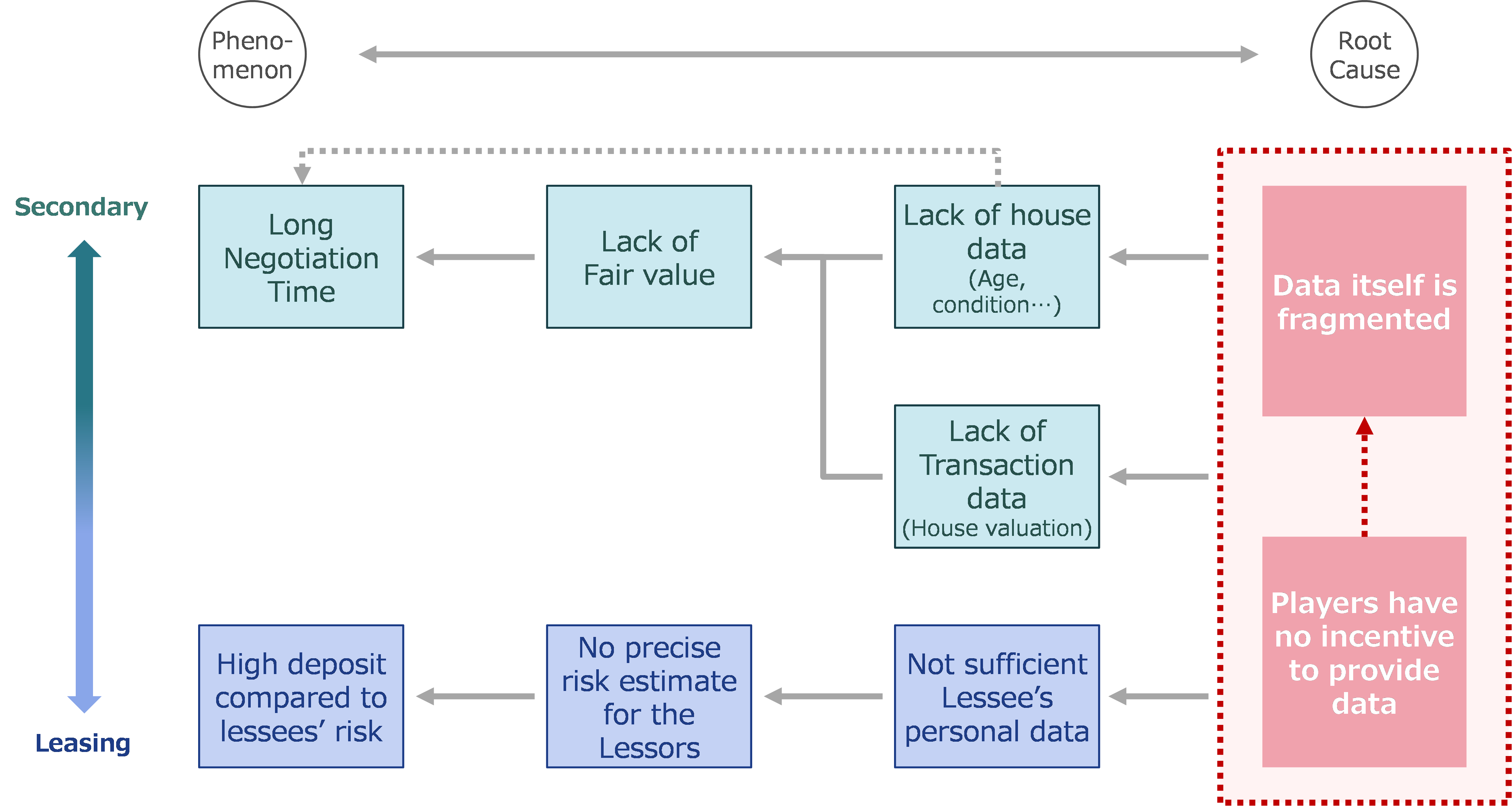

Challenge Identification: DI conducted an in-depth analysis of the current auto-lending ecosystem, engaging stakeholders such as financial institutions, consumers, and dealers. This helped identify pain points, including the lack of a reliable credit rating system, delayed screening, and inconsistent risk management practices.

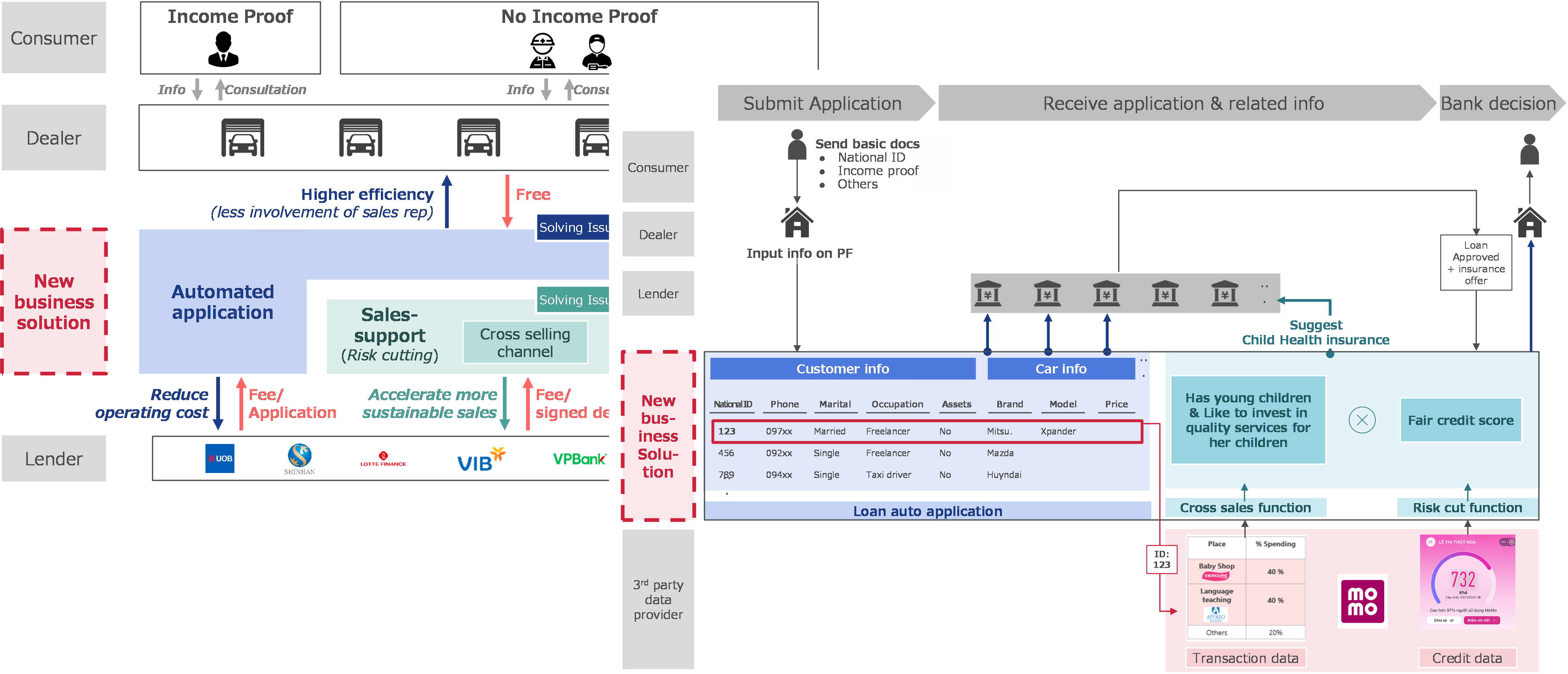

Value Offering Conceptualization and Validation: Based on market insights, DI proposed value offerings such as a streamlined credit assessment mechanism, enhanced loan processing tools, and customized financial products to cater to varied consumer segments.

Business Model Design: DI designed a feasible business model emphasizing collaboration with local banks. The model detailed operational workflows, partnership structures, and revenue generation mechanisms, ensuring alignment with local market dynamics.

Feasibility Assessment: DI evaluated the financial, operational, and regulatory feasibility of the proposed business model, outlining potential risks and mitigation strategies to ensure a smooth market launch.

Strategic Roadmap: A phased implementation plan was developed, providing actionable steps for the client to establish partnerships, pilot the business, and scale operations effectively.

DI’s efforts provided the client with a comprehensive strategy to address market gaps and create a sustainable auto-lending solution in Vietnam.

Image: DI’s proposed methodology for issue identification and business solution conceptualization focuses on capturing the issue’s structure in-depth, rather than settling for a cursory understanding, to accurately determine the root cause of the problem.

Image: DI’s conceptualized business model proposal and workflow demo for pilot implementation.

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

A global shipping carrier, having solidified its presence across the logistics value chain, sought to expand its operations in Vietnam, Cambodia, and Myanmar.

A leading Japanese transportation company explored prospective business development and capital investment opportunities in Vietnam, targeting both B2B and B2C transportation segments. The B2B segment focused on traditional services for domestic manufacturing, distribution, and retail activities, while the B2C segment concentrated on the rapidly growing e-commerce market.

In 2022, the IEA published An Energy Sector Roadmap to Net Zero Emissions in Indonesia. This strategy emphasizes the critical role of low-carbon and carbon-free energy sources, such as hydrogen and ammonia, in achieving carbon neutrality by 2060. It envisions that the development of a hydrogen-based society in Indonesia will significantly contribute to the decarbonization of the global energy system.

L7-11, 7th Floor, Vincom Center, 72 Le Thanh Ton Street, District 1, HCMC, Vietnam

info.vn@dreamincubator.com.vn

+84 28 3827 8450