DI supported a global motorbike company in Southeast Asia

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

DI supported a global trading company in Thailand

• Client: a global trading company

• Country: Thailand

• Industry: Chemicals

Background:

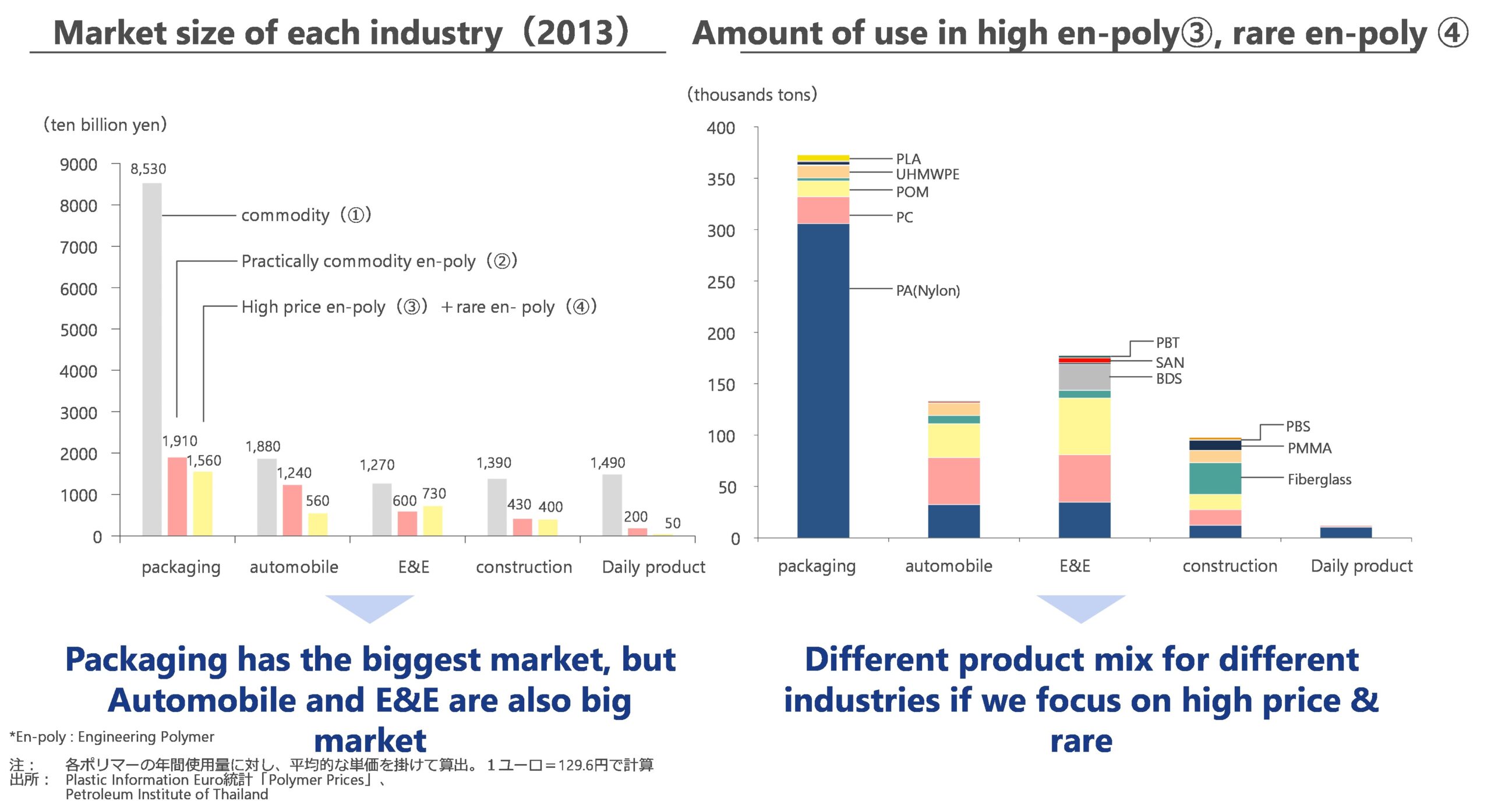

DI was engaged by a global trading company to assess a local target (“X”) for a potential M&A opportunity in Thailand. X operates within the engineered polymers industry and stands out due to its rare capability to handle foreign-engineered polymers, giving it a unique and advantageous position in this niche market. Its only notable competitor, Y, is the sole significant player in the same segment, and X does not directly compete with major global trading companies.

The client’s primary objective is to determine whether X’s business fundamentals align with their investment or collaboration criteria, with a particular focus on long-term stability and minimal risk exposure. This involves analyzing the market environment, evaluating competitive dynamics, and assessing X’s relationships with both suppliers and customers.

Stability appears to be a key consideration for the client, as it ensures that any potential partnership or investment is built on a secure and reliable foundation.

Support overview:

DI provided comprehensive support to a global trading company in evaluating a local M&A target (“X”) in Thailand’s engineered polymers industry. This assessment aimed to determine the robustness of X’s market position and its alignment with the client’s investment criteria, emphasizing stability and low risk.

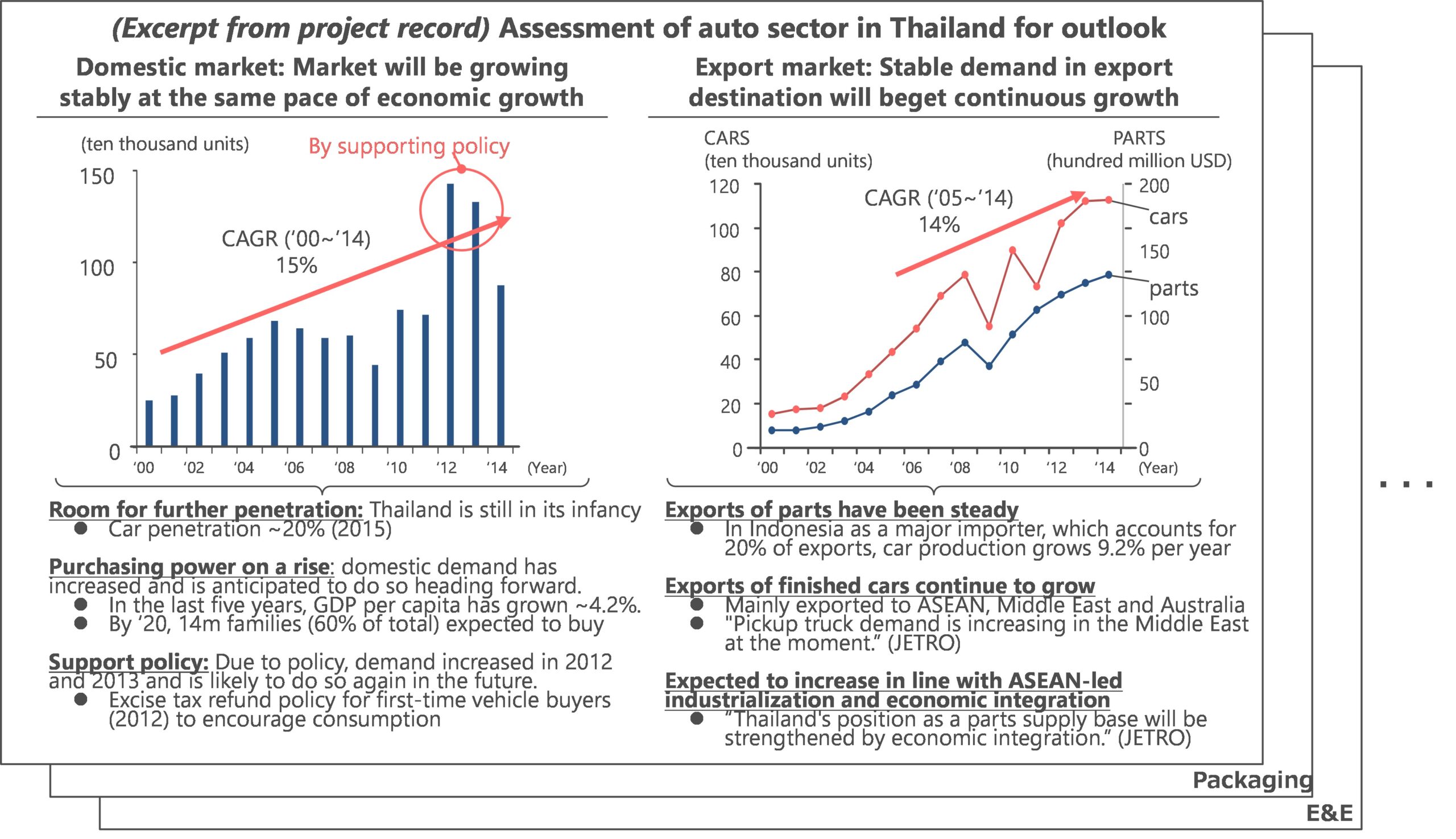

A critical aspect of DI’s support was analyzing the local market dynamics for various polymer applications. The team examined demand trends across key application markets, including manufacturing, automotive, and electronics, to evaluate their growth potential and resilience to external shocks. This involved assessing how different polymer types addressed industry-specific needs and identifying emerging opportunities within Thailand’s industrial landscape.

DI also mapped the dynamics of the local value chain, exploring interactions between raw material suppliers, polymer producers, and end-users. By identifying bottlenecks, dependencies, and opportunities for value addition, the analysis offered insights into the competitiveness and resilience of the overall sector. This value chain analysis was crucial in understanding X’s role and positioning, particularly its ability to handle foreign-engineered polymers—a rare capability in the Thai market.

Additionally, DI scrutinized X’s business model to evaluate its competitiveness. Factors such as operational efficiency, cost structure, market share, and customer relationships were analyzed in detail. The findings highlighted X’s unique position, with minimal competition from significant local or global players, and its capacity to maintain stable supplier and customer networks.

This multi-dimensional assessment enabled DI’s client to make informed decisions regarding the feasibility and potential of the M&A opportunity, ensuring alignment with long-term strategic goals.

Image: excerpt from DI’s market analysis

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

A global shipping carrier, having solidified its presence across the logistics value chain, sought to expand its operations in Vietnam, Cambodia, and Myanmar.

A leading Japanese transportation company explored prospective business development and capital investment opportunities in Vietnam, targeting both B2B and B2C transportation segments. The B2B segment focused on traditional services for domestic manufacturing, distribution, and retail activities, while the B2C segment concentrated on the rapidly growing e-commerce market.

A client exploring the auto-lending market in Vietnam faced a significant challenge: the absence of a reliable credit rating system, which prolonged screening processes and increased the risk of ineffective decision-making. These inefficiencies created barriers to market growth and constrained the ability of lenders to extend loans confidently.

L7-11, 7th Floor, Vincom Center, 72 Le Thanh Ton Street, District 1, HCMC, Vietnam

info.vn@dreamincubator.com.vn

+84 28 3827 8450