DI supported a global motorbike company in Southeast Asia

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

DI supported a global non-life insurance company in Vietnam

• Client: a global non-life insurance company

• Country: Vietnam

• Industry: Insurance

Background:

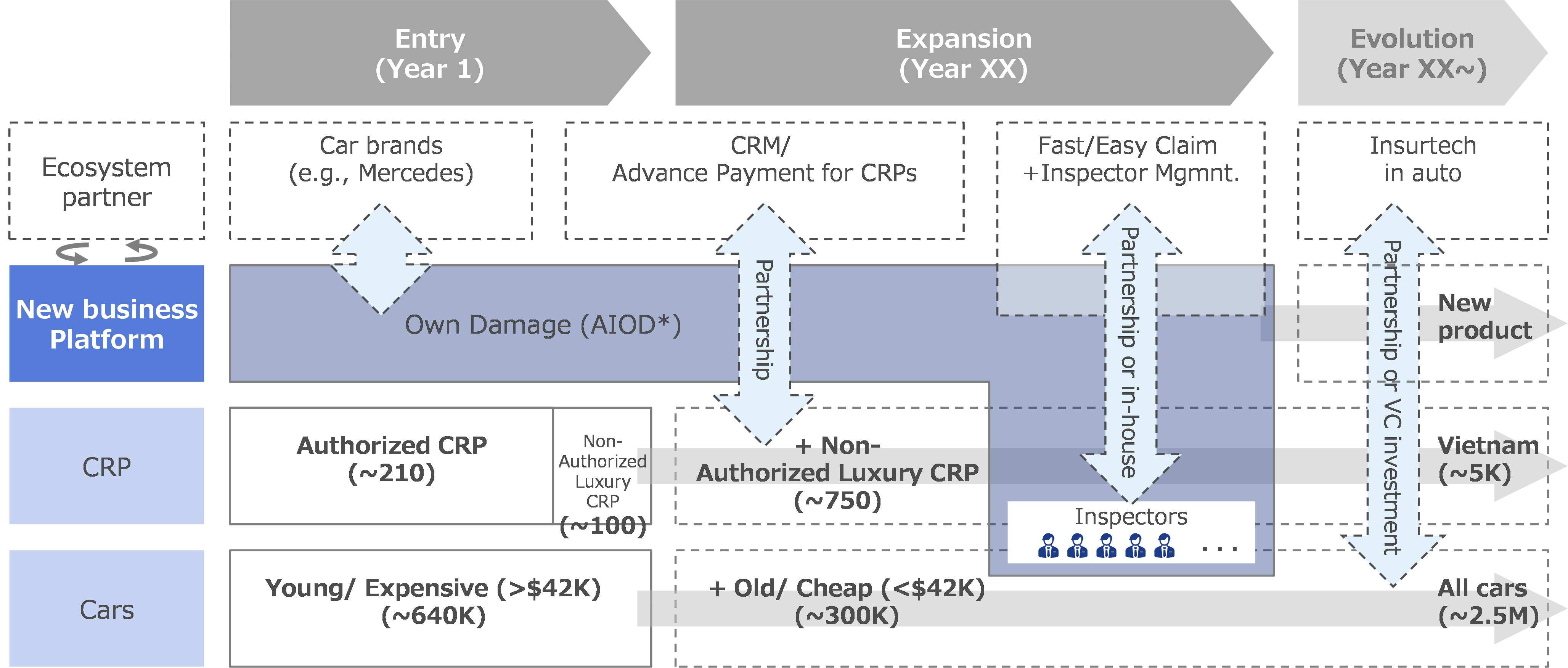

A client company was developing a strategy for automobile insurance business expansion in Vietnam. A key focus of this strategy involves partnerships with garages, referred to as Car Repair Points (CRPs), to facilitate business growth. Given that your operations in Vietnam are still in their early stages, forming partnerships could significantly reduce operational burdens and enable rapid expansion.

From a macroeconomic perspective, Vietnam presents a promising opportunity. The country’s strong economic growth, coupled with robust trends in motorization and retail modernization, further supports the potential for expansion in the automobile insurance sector.

Support Overview:

DI consultants were engaged to establish a solid partnership model and ensure successful implementation. The following key areas need to be closely examined:

Assessment of the Repair Garage Sector in Vietnam

Evaluation of Potential Partnerships

We offered to our client in the project a thorough understanding of the overall market landscape. Following the analysis, we provided strategic options for partnership models, including actionable recommendations and collaboration plans for implementation.

Image: DI’s business planning concept for the client’s implementation

A global motorbike manufacturer observed a shift in consumer behavior as motorbike markets in Vietnam, Thailand, and Indonesia matured and became commoditized.

A global shipping carrier, having solidified its presence across the logistics value chain, sought to expand its operations in Vietnam, Cambodia, and Myanmar.

A leading Japanese transportation company explored prospective business development and capital investment opportunities in Vietnam, targeting both B2B and B2C transportation segments. The B2B segment focused on traditional services for domestic manufacturing, distribution, and retail activities, while the B2C segment concentrated on the rapidly growing e-commerce market.

A client exploring the auto-lending market in Vietnam faced a significant challenge: the absence of a reliable credit rating system, which prolonged screening processes and increased the risk of ineffective decision-making. These inefficiencies created barriers to market growth and constrained the ability of lenders to extend loans confidently.

L7-11, 7th Floor, Vincom Center, 72 Le Thanh Ton Street, District 1, HCMC, Vietnam

info.vn@dreamincubator.com.vn

+84 28 3827 8450