A carbon market could be the key to fuel Vietnam’s bold green dream, set free.

Vietnam rises in the global race to heal a warming world.

Figure 1: Commitments to United Nations at COP28 by several countries in Asia

Climate change is a global crisis, impacting every inhabited region. To mitigate its devastating effects, urgent climate action is imperative. Nations worldwide are increasingly committed to reducing greenhouse gas (GHG) emissions, setting ambitious targets for carbon neutrality and net-zero emissions. Vietnam stands among these nations, demonstrating unwavering dedication to its ambitious climate goals. To finance this ambitious transition plan, Vietnam is strategically mobilizing domestic resources and seeking international support. According to the World Bank, Vietnam’s estimated annual investment needs for a resilient and decarbonized future could reach $368 billion over the next two decades, representing approximately 6.8% of its GDP[1].

A carbon market could spark both greater environmental accountability and the unlocking of new financial avenues for sustainable development.

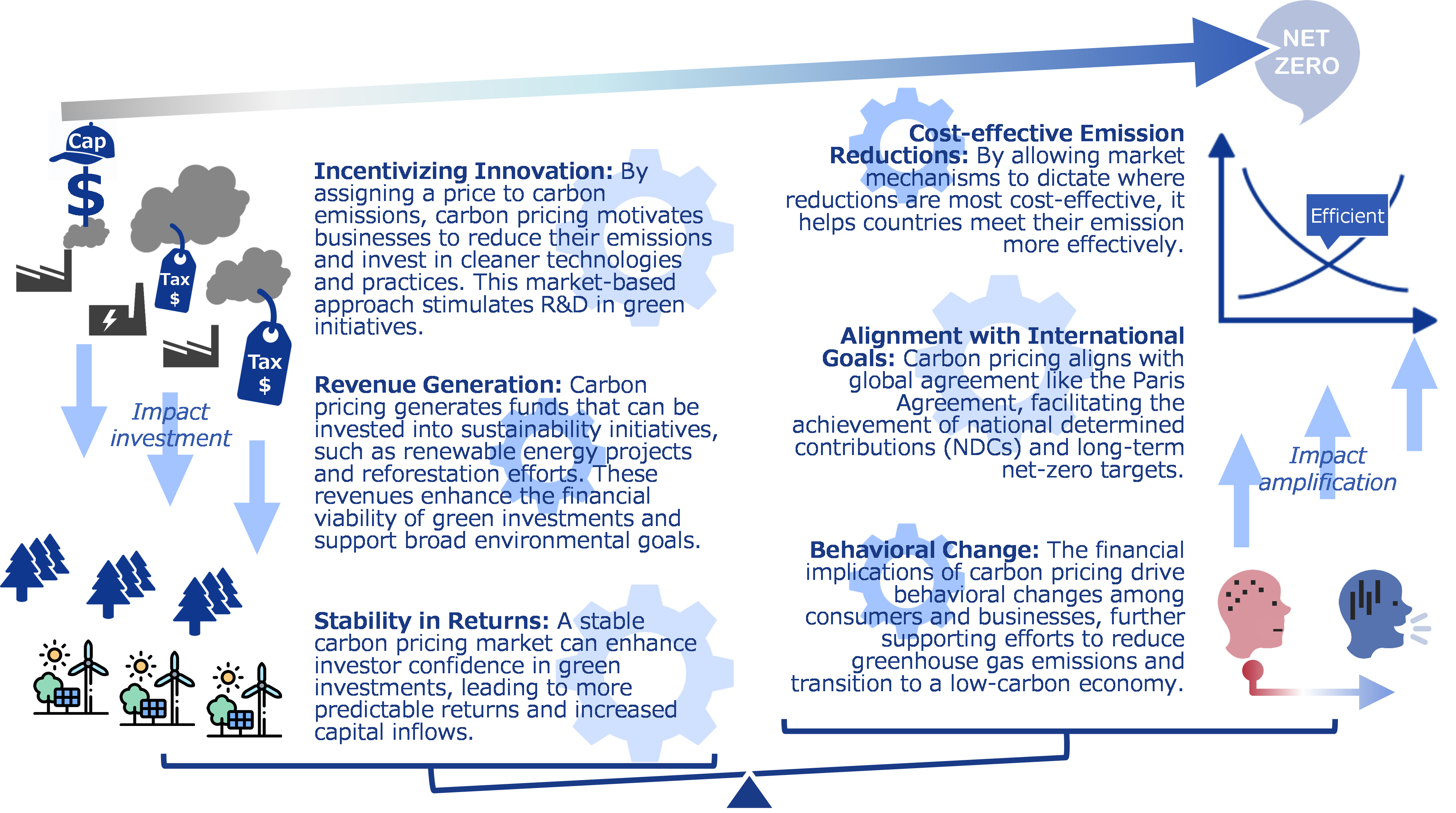

Carbon pricing mechanisms are essential tools in the fight against climate change. By placing a monetary value on greenhouse gas emissions, these mechanisms ensure that the environmental costs of production and consumption are factored into decision-making. This promotes cost-effective emissions reduction and incentivizes the shift towards a low-carbon economy.

Figure 2: Carbon pricing, implemented through mechanisms such as carbon taxes or cap-and-trade systems, significantly influences investments in green projects and helps achieve national emission reduction targets.

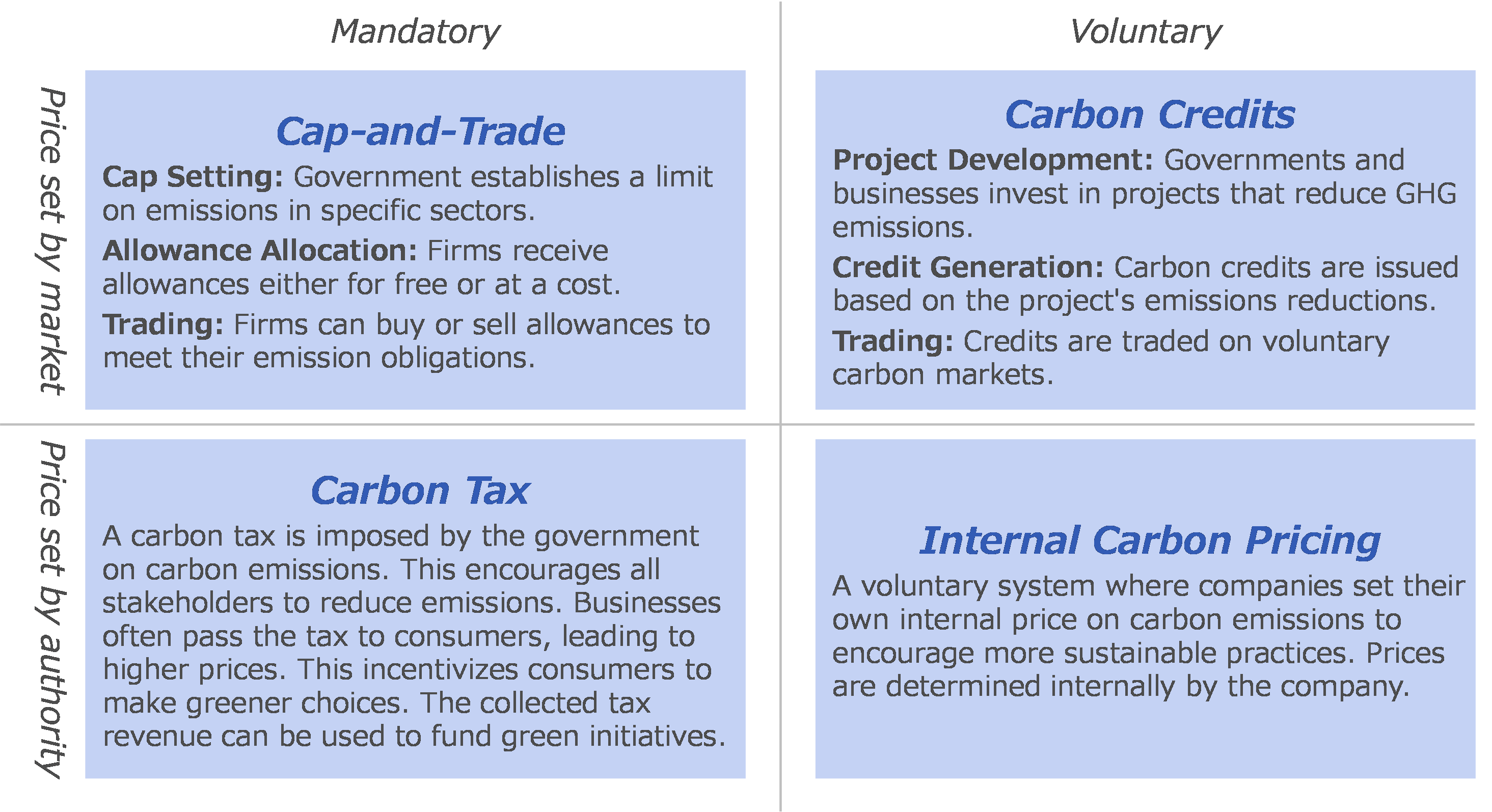

2 primary types of Carbon pricing mechanisms: mandatory and voluntary.

Figure 3: Different Types of Carbon Pricing Mechanisms A mandatory carbon market is regulated by governments, requiring entities to limit their emissions by either imposing a tax or setting a cap on emissions. For example, in a cap-and-trade system, companies are given or must purchase emission allowances. Companies that exceed their caps must buy additional permits, while those that emit less can sell their surplus. The system aims to reduce overall emissions over time and penalizes non-compliance, creating a structured, enforceable approach to lowering carbon footprints.

A mandatory carbon market is regulated by governments, requiring entities to limit their emissions by either imposing a tax or setting a cap on emissions. For example, in a cap-and-trade system, companies are given or must purchase emission allowances. Companies that exceed their caps must buy additional permits, while those that emit less can sell their surplus. The system aims to reduce overall emissions over time and penalizes non-compliance, creating a structured, enforceable approach to lowering carbon footprints.

Figure 4: Offset volumes in kTons CO2 purchased by major global corporations

(Source: Statista, Bloomberg) A voluntary carbon market allows companies or individuals to purchase carbon offsets voluntarily, often to meet corporate sustainability goals or demonstrate environmental responsibility. Participants invest in carbon-reducing projects, such as reforestation or renewable energy, to offset their emissions. These markets operate without regulatory mandates, and the credits bought are typically verified by independent third parties, helping to support green initiatives without legal obligation.

A voluntary carbon market allows companies or individuals to purchase carbon offsets voluntarily, often to meet corporate sustainability goals or demonstrate environmental responsibility. Participants invest in carbon-reducing projects, such as reforestation or renewable energy, to offset their emissions. These markets operate without regulatory mandates, and the credits bought are typically verified by independent third parties, helping to support green initiatives without legal obligation.

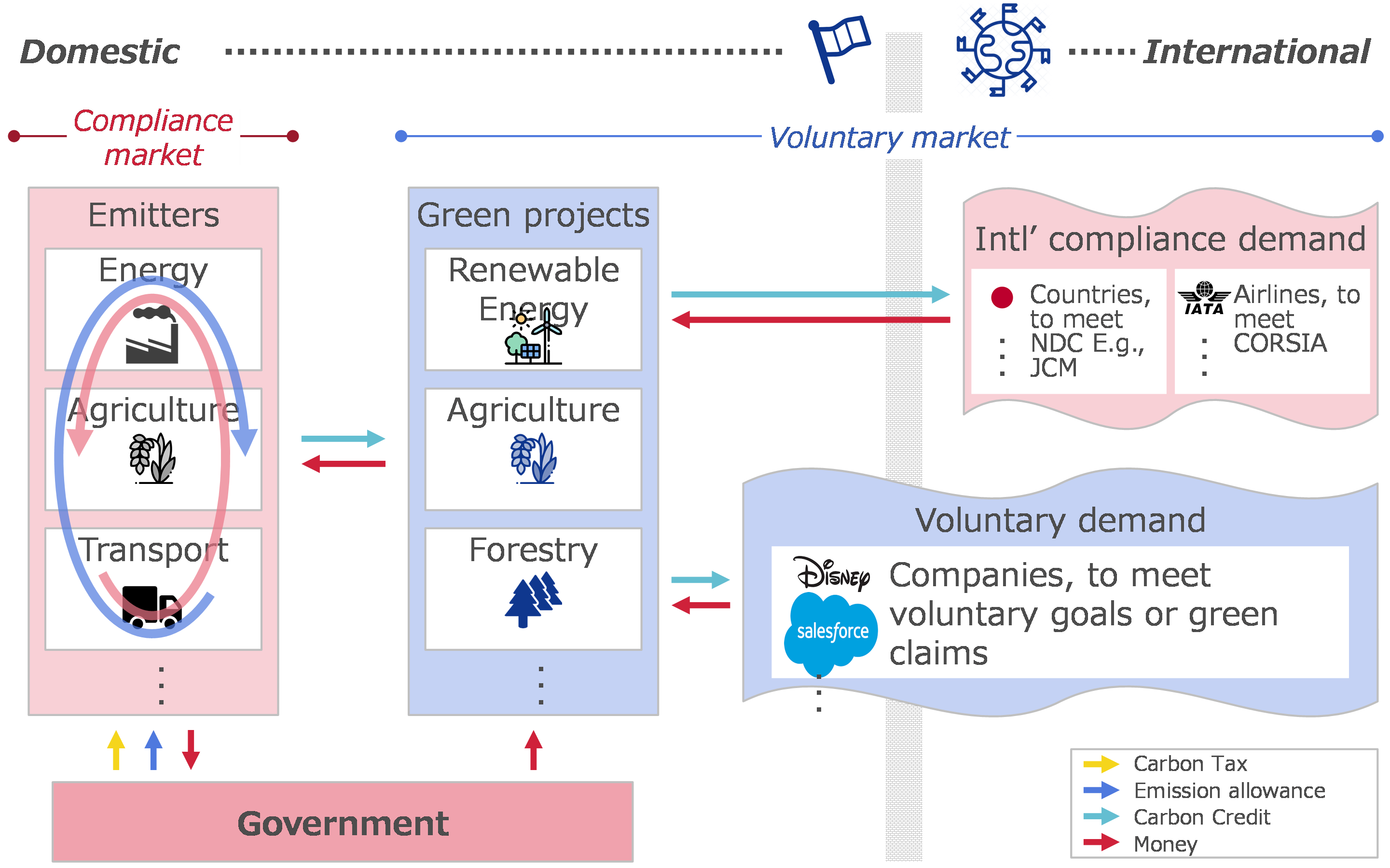

Carbon markets operate at various jurisdictional levels. Examples of mandatory markets include Tokyo’s local cap-and-trade program, China’s national ETS, and the EU’s regional ETS. Voluntary markets encompass initiatives like Beijing’s local offset mechanisms, the Indo-Pacific regional scheme, and internationally traded credits certified by bodies like Gold Standard and Verra.[2]

Yet even mechanisms within the same market system do not necessarily produce the same economic impact. In mandatory systems, a carbon tax provides price certainty with a fixed cost on emissions, while cap-and-trade ensures emissions certainty by capping total emissions. Cap-and-trade offers governments more control over national emissions but may discourage innovation due to uncertain prices. Carbon taxes usually have broader coverage, including more polluters, and are easier to administer since many countries already have tax systems. However, emissions trading systems (ETS) may be favored for legal reasons, as seen in the EU, where implementing an ETS requires a qualified majority, while a carbon tax would need unanimous approval.

Furthermore, in the voluntary systems, while carbon credit prices are market-determined, organizations may also choose to implement internal carbon pricing. This practice can be used to evaluate investment proposals and guide decision-making.

Hybrid systems combining mandatory and voluntary elements are also emerging as countries explore ways to develop and expand carbon markets.

In this hybrid system, Emitters from Compliance market can use Carbon Credit from Voluntary market to offset emissions, subject to each country’s eligible rules, typically regarding the eligible carbon crediting mechanisms and the limits that emitters are allowed to offset using Carbon Credit. For example, Singapore allows companies to use carbon credits to offset up to 5% of their taxable emissions. This is also the popular rate adopted by many other Governments, like China, Thailand. Regarding crediting mechanism, there are 3 types: international crediting mechanisms established under international treaties, such as the Kyoto Protocol and Paris Agreement; domestic crediting mechanisms established by regional, national, or subnational governments, such as the California Compliance Offset Program; and independent crediting mechanisms (or independent standards), which include standards and crediting mechanisms managed by independent nongovernmental entities, for example Verra’s Verified Carbon Standard (VCS) and Gold Standard.

Figure 5: Hybrid system of Carbon market To facilitate the international transfer of carbon credits, Article 6 of the Paris Agreement establishes specific rules. Japan’s Joint Crediting Mechanism (JCM) is a notable example, fostering partnerships between Japan and developing countries to reduce emissions. JCM, established in 2013, aims to facilitate the diffusion of advanced decarbonizing technologies and mitigation actions in partner countries to help achieve Japan’s GHG emission reduction targets[3]. Japan has signed bilateral agreements with 29 countries, with which more than 200 projects under JCM methodologies have been financed, primarily in Indonesia, Vietnam, and Thailand. As of 18 March 2024, a total of more than 88,000 carbon credits have been issued, with over 60,000 credits transferred to Japan[4].

To facilitate the international transfer of carbon credits, Article 6 of the Paris Agreement establishes specific rules. Japan’s Joint Crediting Mechanism (JCM) is a notable example, fostering partnerships between Japan and developing countries to reduce emissions. JCM, established in 2013, aims to facilitate the diffusion of advanced decarbonizing technologies and mitigation actions in partner countries to help achieve Japan’s GHG emission reduction targets[3]. Japan has signed bilateral agreements with 29 countries, with which more than 200 projects under JCM methodologies have been financed, primarily in Indonesia, Vietnam, and Thailand. As of 18 March 2024, a total of more than 88,000 carbon credits have been issued, with over 60,000 credits transferred to Japan[4].

Vietnam’s potential shines in the voluntary carbon credit market, where the emission reduction holds a billion-USD promise by 2030.

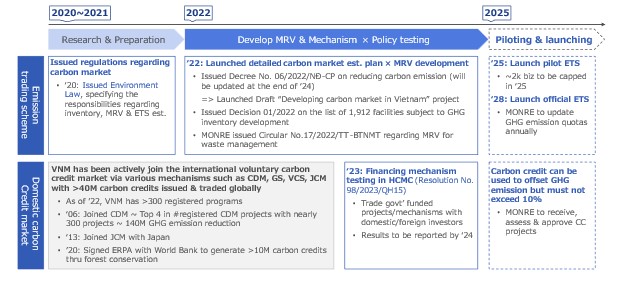

Vietnam government is laying the foundation for Vietnam’s carbon market. Despite being in the initial phases, Vietnam has already gained significant experience through its indirect participation in various international carbon trading schemes. For example, under the Emission Reductions Payment Agreements (ERPA) in the North Central region signed on October 22, 2020, between the International Bank for Reconstruction and Development (IBRD) of the World Bank (WB) and the Ministry of Agriculture and Rural Development (MARD), Viet Nam sold over 10 million forest carbon credits in 2023[5]. These early engagements have provided invaluable insights and set the stage for the creation of Vietnam’s own carbon market, both for compliance and voluntary.

The potential for Vietnam’s voluntary carbon market is particularly promising. With the global voluntary carbon credit market projected to reach $1 trillion by 2050, Vietnam has a unique opportunity to tap into this growing space by leveraging the resource from forestry, energy, and agriculture. Beyond financial gains, a well-developed voluntary market can attract more “green foreign direct investment” (FDI), helping the country align with global sustainability standards. Additionally, having a robust voluntary carbon market would enable Vietnam to meet increasingly strict environmental requirements from developed markets such as the EU’s Carbon Border Adjustment Mechanism (CBAM), ensuring smoother export processes. As the world shifts towards a low-carbon economy, Vietnam’s voluntary carbon market will position the country as a competitive player in the global green economy, while supports the country’s broader ambition to achieve its Net Zero target by 2050.

Global carbon credit market valued at ~$3 billion in 2022, and potential demand could reach up to ~$1 trillion by 2050.

Figure 6: Estimated Size of Global voluntary Carbon Credit market (potential demand-basis)The global carbon credit market has reached approximately 500 million tons of CO2, primarily issued under the Clean Development Mechanism (CDM), Verified Carbon Standard (VCS), and Gold Standard (GS). The market value could be as high as $3.1 billion, though prices highly fluctuate. Regarding future prospect, depending on various scenarios, potential demand could range from $5 billion to over $50 billion by 2030 with possibilities of exceeding $1 trillion by 2050[6].

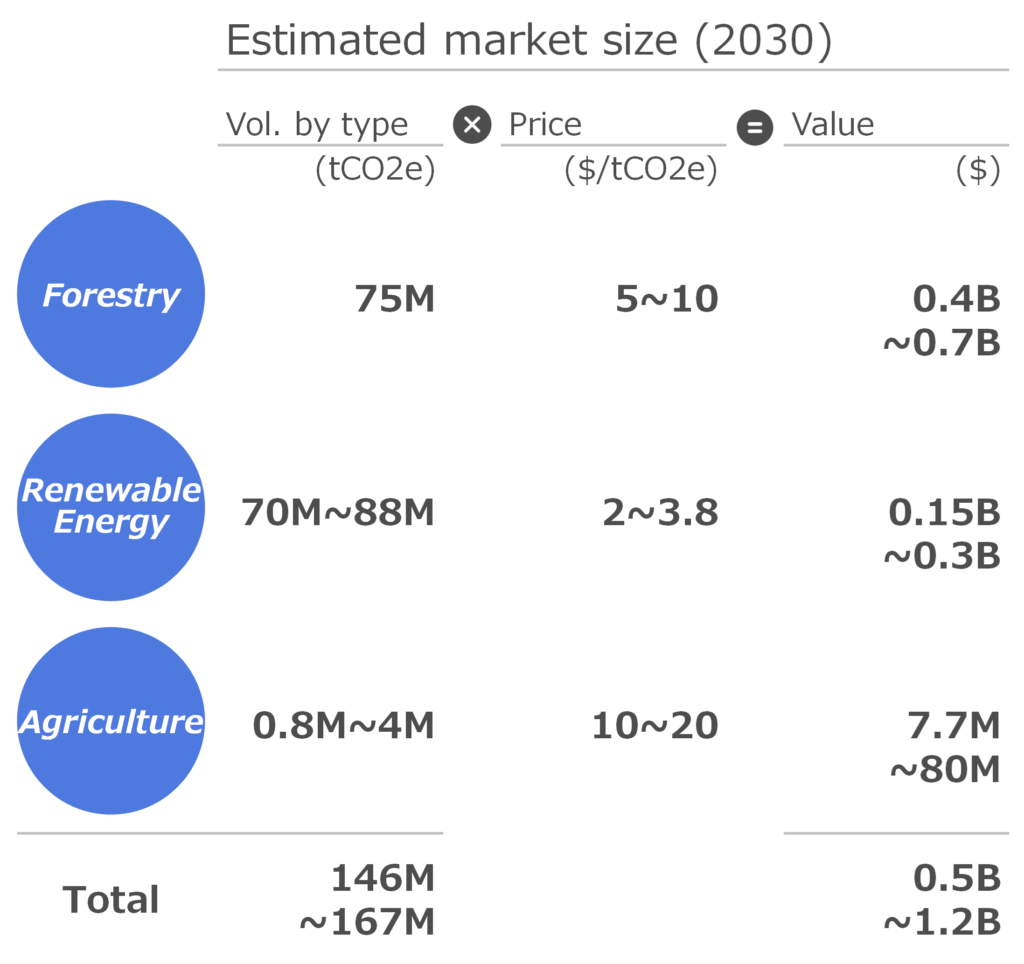

Vietnam could unlock up to $1.2 billion in carbon credits from its Renewable Energy, Forestry, and Agriculture resources.

Forestry, Renewable energy and agriculture are Vietnam’s key sources for Carbon credits.

Worldwide, popular sources of carbon credits issuance are Renewable energy (~55%), Forestry & land use (15 – 20%), and others including Chemical process / Industrial manufacturing, Household / Community devices, Energy efficiency / Fuel switching etc. Recently, there has been a growing focus on nature-based activities, covering emissions reductions especially from agriculture.

Vietnam, leveraging its vast forestry resources, successfully sold 10.3 million high-quality carbon credits to the World Bank in 2023, with another phase planned for 2024. Renewable energy is also a promising source of carbon credit as the Government is focusing on sustainable energy transition. At COP28, Vietnam’s Prime Minister Pham Minh Chinh presented a 200-page implementation plan for Just Energy Transition Partnership (JETP), which has pledged approximately 16B USD in public and private funding for energy transition projects from 2023 to 2030. Another potential source of domestic carbon credit production of Vietnam lies in agriculture, especially in rice cultivating. With 50% rice capacity comes from Mekong Delta and increasing climate negative impacts from rice cultivation, Vietnamese government has implemented a “1 million ha of low-emission high-quality rice in Mekong Delta[7]”, considered as one of biggest CO2-agriculture reduction project in SEA.

Figure 7: Estimated Size of Vietnam voluntary Carbon Credit market

Figure 7: Estimated Size of Vietnam voluntary Carbon Credit market

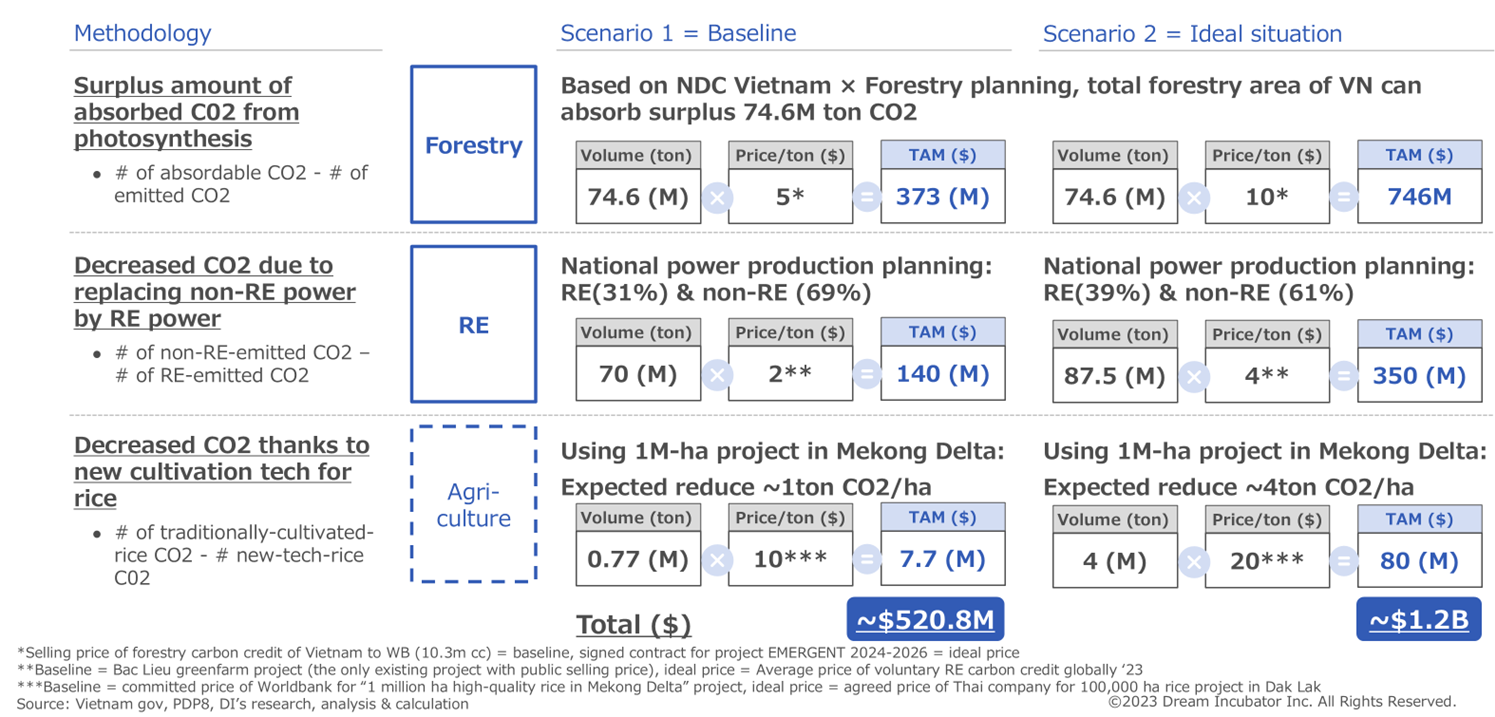

With enormous potential from forestry, renewable energy and agriculture, Vietnam’s Voluntary Carbon Credit market is estimated to reach the range from $0.5 Billion up to $1.2 Billion in 2030[8], equivalent to 146 – 167 million tons of reduced CO2 emissions.

Note on estimation approach

※Forestry: Surplus amount of absorbed C02 from photosynthesis (Estimated by MONRE)

※Renewable Energy: Decreased CO2 due to replacing non-RE power by RE power (Planned %RE ranges within 31%~39% in PDP8)

※Agriculture: Decreased CO2 thanks to new cultivation tech for rice (amount of CO2 decreased ranges from 1 tCO2/ha to 4 tCO2/ha)

The Vietnam market is still developing and needs more progress to reach its full potential by addressing key challenges and fixing current gaps.

Current Vietnam market is in nascent stage compared to regional peers.

As Vietnam explores the potential of a carbon market, its participants face challenges in navigating the evolving landscape. While the market holds promise, Vietnam remains in the early stages compared to more established markets like Singapore and Thailand.

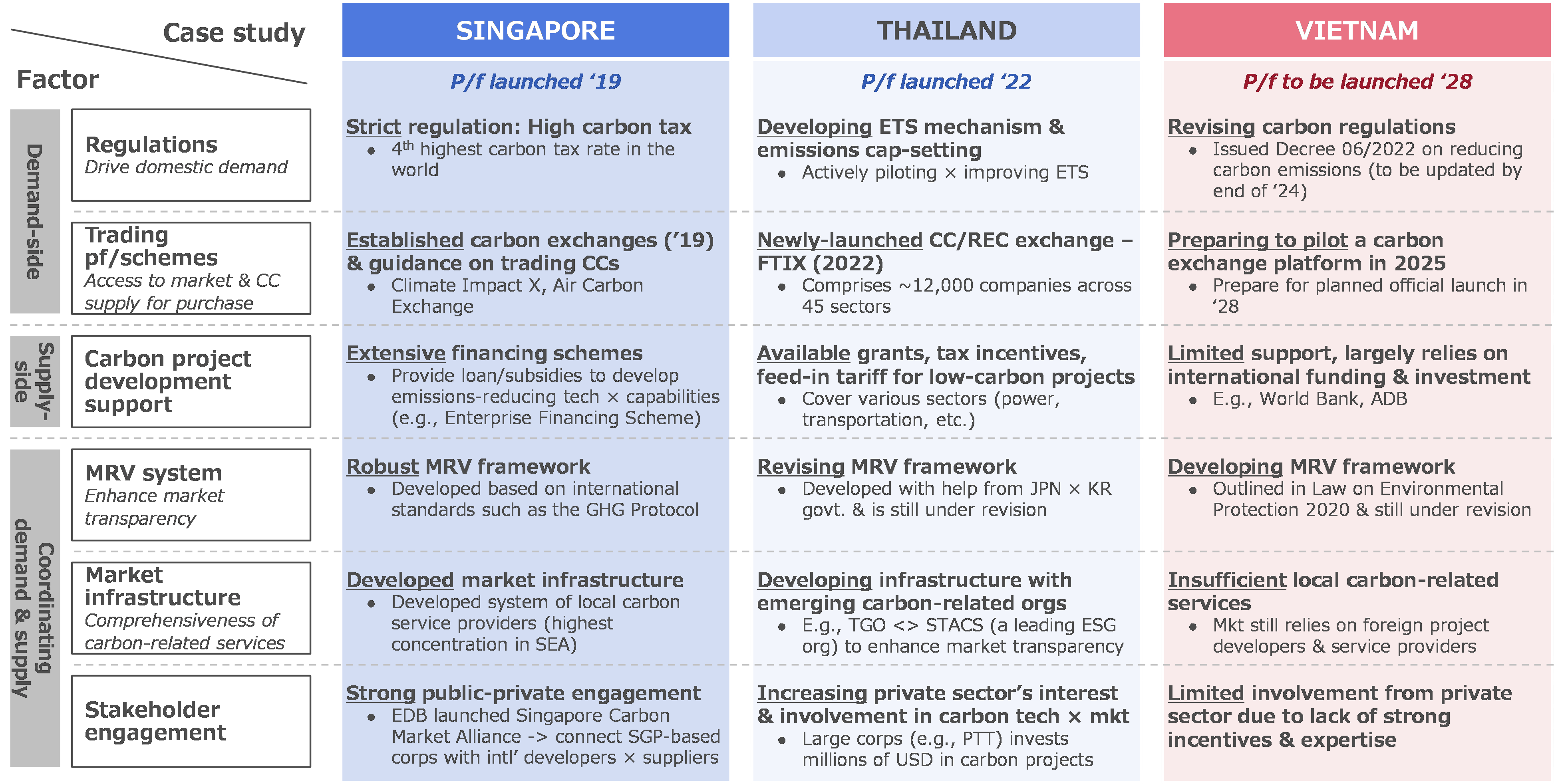

To trigger and facilitate the demand of Carbon credit, Singapore boasts the fourth highest carbon tax globally at $5/tCO2 and has developed significant market infrastructure, including exchanges like Climate Impact X and Air Carbon Exchange since 2019. Thailand has been actively piloting its ETS and officially launched a carbon trading platform in 2022. Vietnam, on the other hand, is still in the process of developing its regulations and trading scheme.

In terms of carbon credit supply, even though Vietnam has a decent number of registered carbon projects, the country still largely relies on international funding and investment, lacking sufficient support and incentives from the government. In contrast, Singapore has a leading position in the region regarding green financing, offering extensive financing schemes to businesses to encourage the development of emission-reducing technologies. On a lesser scale, Thailand has also started offering grants, tax incentives, or feed-in tariff for low-carbon projects across sectors.

Furthermore, Singapore’s well-developed carbon market is supported by a network of local carbon service providers, including consultancies, technology providers, project developers, and verification bodies. This ecosystem, which hosts the highest concentration of carbon service providers in Southeast Asia, enables efficient project development, monitoring, reporting, and verification processes. In contrast, Vietnam local network of service providers is still developing.

Figure 8: Vietnam’s market situation compared to Singapore & Thailand

Carbon credit developers in Vietnam face major challenges such as lacking expertise and clear guidance from the government.

Local developers are crucial to the success of the carbon credit market, yet those in Vietnam are facing significant challenges. Even in the most established sector regarding carbon credit production – forestry – developers still lack basic tools and knowledge to navigate this new market. A primary barrier is the lack of detailed government guidance, leaving developers uncertain about credit ownership rights, policies on trading or transferring credits, and the governance of revenue from forestry-related carbon services.

“A big issue in the industry is determining who has the right to own carbon credits generated from forest, since there is still dispute around forest ownership…” Mr. Lan, CEO of Vietnam Digital Solutions – offering carbon-related services including carbon project development, carbon strategy consulting, CC provision, assessment & reporting

Additionally, there is no clear allocation of emission cap and trading quotas at regional level, which complicates the development planning and trading of carbon credits across regions. According from Mr. Thanh – expert from Green Carbon Inc, a Japanese carbon startup that has been developing low-carbon agricultural projects across Vietnam – the private sector is still waiting for detailed regulations from the government regarding both domestic and international trading of carbon credits.

“Carbon credit trading in the market is still unregulated. The government has plan to add international trading quota on an industry-level to the revised version of Decree No. 06 but there has not been anything said about the cap for each region…” Mr. Thanh, Expert from Green Carbon Inc. – Japanese carbon project developer with agri. projects across 7+ provinces in Vietnam

The absence of developed monitoring, reporting, and verification (MRV) guidelines further exacerbates the situation. Since there is no formal agreement on standards and how to verify credits, many developers in the forestry sector find it hard to communicate with potential buyers and negotiate carbon credit prices.

“We have been waiting for 3 years but the government still hasn’t provided a complete guideline on how to measure, report, and verify carbon credits. There is also no standard set out for forestry credits yet…” Mr. Lan, CEO of Vietnam Digital Solutions

As carbon credit is just emerging in Vietnam, many in the industry are still unfamiliar with the fundamentals of carbon credits, including the definition of forestry carbon credits, the different methodologies for generating them, and the MRV procedures regarding this type of carbon credit. This knowledge gap is a key barrier hindering their capability to navigate and effectively contribute to the market.

Alternatives to enhance the value of Vietnam-produced carbon credits.

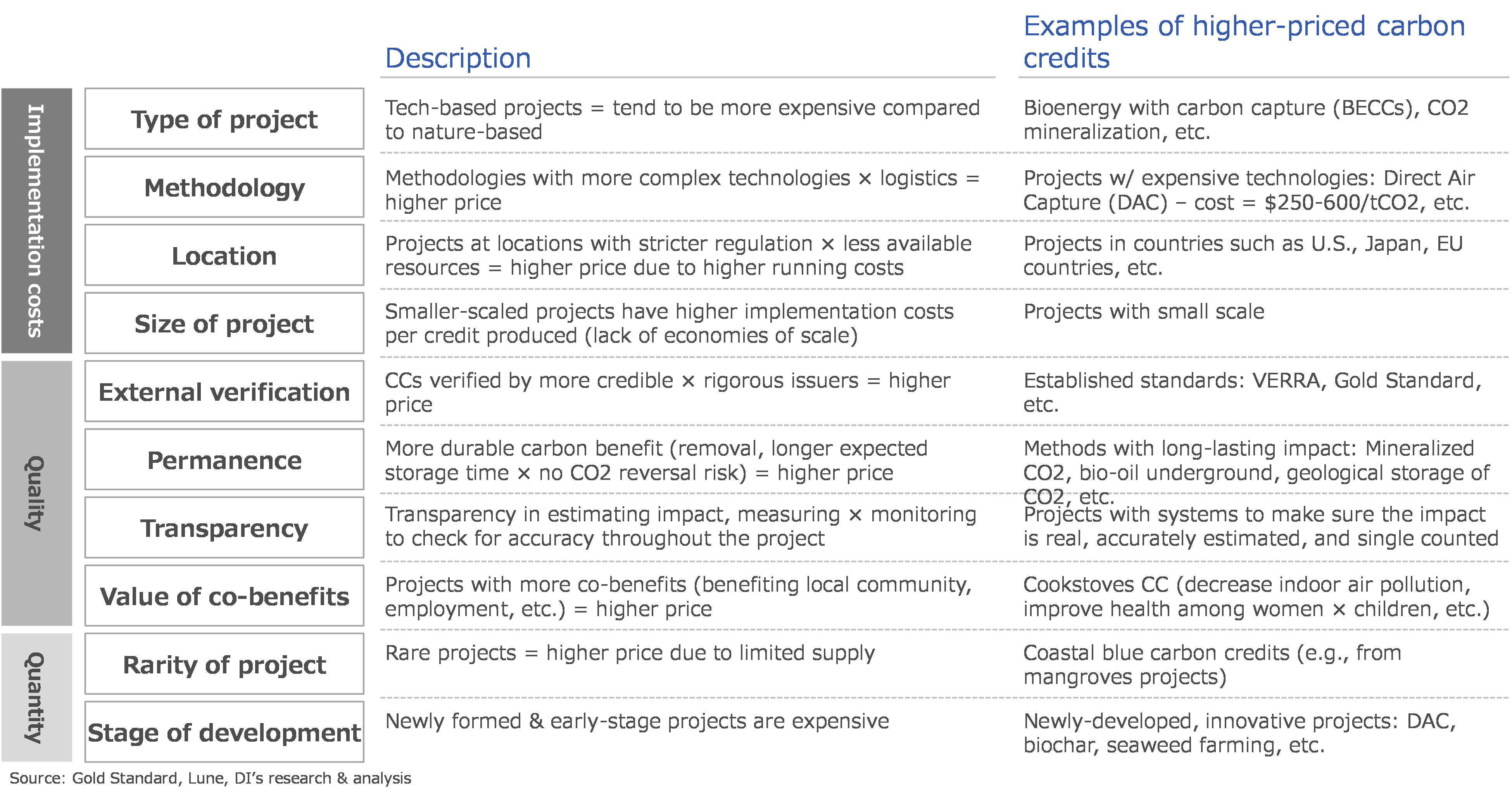

The price of carbon credits on the voluntary market can be extremely volatile and usually varies across projects. However, there are a few key factors influencing carbon credit price, such as implementation costs of the carbon projects, perceived quality of the credits, and supply-demand of that specific credit type at the time of trading.

The implementation costs of a project depend on many factors, such as the methodology used for reducing emissions or the location of the site. Likewise, there are many factors influencing the perceived quality of carbon credits. Credits from projects with seemingly more durable benefits, higher level of transparency, or more valuable co-benefits to the local community, are typically considered to be of higher quality and hence are priced higher.

Alongside establishing an efficient carbon market, the Vietnamese government and relevant stakeholders should take appropriate actions to enhance the value of locally produced carbon credits in both domestic and international market. There are a few initiatives to be considered as a first step, as stated below.

Develop and/or adopt more advanced low carbon methodologies

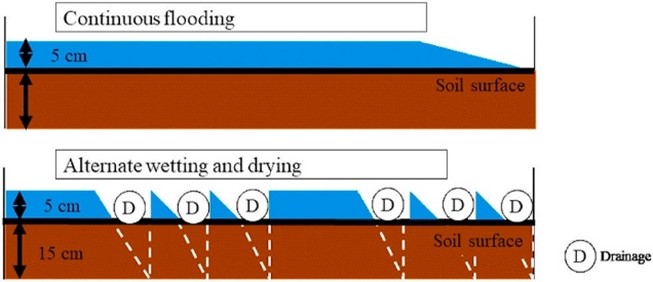

Methodologies and technologies used in many notable carbon projects in Vietnam are developed by foreign developers, and there is still a lot of room for enhancing these technologies. In Vietnam, developers are starting to apply new technologies and techniques in offsetting CO2 emissions, however, more commonly applied technologies such as alternate wetting and drying (AWD) only generate carbon credits that sell for $5-10, a big gap from price of credits generated from high-technology projects available in the international market such as Direct Air Capture technology – which can reach up to $200-300 per credit.

Figure 9: AWD technique reduces carbon emissions by alternating between flooded and dry soil conditions, disrupts the anaerobic environment that fosters methane-producing bacteria. (Source: Leon & Izumi, 2022[9])

Figure 9: AWD technique reduces carbon emissions by alternating between flooded and dry soil conditions, disrupts the anaerobic environment that fosters methane-producing bacteria. (Source: Leon & Izumi, 2022[9])

Figure 10: Direct Air Capture technology extracts CO2 directly from the atmosphere – an air contactor pulls in air and passes it over surfaces coated with chemical solution that binds with CO2, then a pellet reactor processes the solution to precipitate the increased CO2 concentration out as solid pellets, which are then heated to release pure CO2 gas, while regenerating the original capture chemical (Source: Proximo[10])

Figure 10: Direct Air Capture technology extracts CO2 directly from the atmosphere – an air contactor pulls in air and passes it over surfaces coated with chemical solution that binds with CO2, then a pellet reactor processes the solution to precipitate the increased CO2 concentration out as solid pellets, which are then heated to release pure CO2 gas, while regenerating the original capture chemical (Source: Proximo[10])

Increase transparency in the carbon market

Establishing clear rules, regulations and infrastructure for the domestic carbon market will boost the confidence of both sellers and buyers. A national registry to track credits, clear rules on credit issuance and transfers, and transparent pricing will make the market more attractive to potential buyers, especially buyers in demanding markets such as the EU or North America.

Enhance and highlight the co-benefits of Vietnam-produced credits

Vietnam’s carbon projects often deliver valuable co-benefits like poverty alleviation, biodiversity conservation, and sustainable development. Quantifying and marketing these co-benefits will differentiate Vietnam’s credits and increase their value in the voluntary market. By focusing on these areas, Vietnam can position itself as a leader in high-quality, high-impact carbon credits. This will attract more investment in its carbon market and generate greater revenues to fund climate action and sustainable development.

Figure 11: Factors influencing the market value of carbon credits

Future: Vietnam dreams of incubating new industries born from a green transformation, where success blooms through the hands of both public and private sectors working together.

Vietnam is striving to create a Green Economy.

To achieve Carbon Neutrality, Vietnam must foster the growth of a new industry that fully leverages governmental and private resources, as well as international cooperation and support. Under the framework of a Green Economy, companies in key emission-intensive sectors will be doubly incentivized to transition toward sustainability. First, they can benefit from technology and capital transfers provided through government partnerships and green financing mechanisms with international partners. Second, they can tap into additional revenue streams through carbon credit trading, enabled by the development of a robust carbon market.

Figure 12: DI’s hypothetical image of the Vietnam’s Green Economy structure

Vietnam is making significant strides in building a robust domestic carbon market.

Vietnam is working to establish its carbon market, with a goal of implementing regulations for carbon credit management and greenhouse gas emission quota exchanges by the end of 2027. Following Decree No. 06/2022/NĐ-CP, which provides a roadmap for developing the carbon market, several supporting documents have been issued. The country plans to pilot a emission trading system starting in 2025, with official operations set to begin in 2028.

Figure 13: Vietnam’s roadmap to establishing a domestic carbon market and its current progress

Beyond government initiatives, private sector involvement is crucial, especially in pioneering innovative business models.

As stated above, Vietnam might need $368 billion for a decarbonized future. However, the state budget funding can only cover about $130 billion[11], meaning that the participation of private sector is extremely important.

Around the globe, many innovative business models have been arising to capture the business opportunities the green transition has created. One notable example is the Eastwood Climate Smart Forestry Fund I, recently launched by Sumitomo Forestry, which has a total investment of around ¥60 billion (over $420 million). This fund involves ten Japanese corporations, including ENEOS Corporation, Osaka Gas, and Sumitomo Mitsui Banking Corporation, and aims to enhance forest management practices to combat climate change. It plans to acquire and manage approximately 130,000 hectares of forest in North America over a 15-year period. By implementing sustainable forestry practices, the fund seeks to sequester an additional 1 million tons of CO2 annually, with the generated carbon credits available for trading, thus providing financial returns while contributing to biodiversity and water resource management. Sumitomo Forestry also has more than 10 years of business operation in Vietnam, and the Vietnam Government is welcoming its expansion in the forestry & energy sector. [12]

Besides the “Physical green infrastructure” businesses like the forestry fund model mentioned above, there are another group of business solution targeting at building “Data collection Infrastructure”, like IoT devices that collect real-time data, satelite imaginary, supply chain tracking systems, and “Technology infrastructure” like cloud-base data analytics tools that enables the visualization, analysis and reporting of “green” data. Vietnam has seen the emerging of those start-ups recently, showing the dynamics in green innovation and transition. There are numerous innovative companies working towards environmental sustainability. Startups offer various solutions, ranging from emission tracking and reduction for fleet management in the transportation sector to integrated carbon management solutions for supply chains, focusing on transparency based on scientific principles. Additionally, some emerging platforms leverage data from sensors, satellites, and IoT devices to provide a detailed view of environmental, social, and governance (ESG) metrics, helping financial institutions manage and invest in sustainable projects. Recently, major banks in Vietnam have begun partnering with tech startups to help their corporate clients calculate and visualize greenhouse gas emissions across operations and supply chains[13].

To sum up, carbon market can be a key for Vietnam to achieve its green commitments and enable the formulation of new industries, to capture the promising voluntary carbon market. As Prime Minister Pham Minh Chinh stated in the P4G (Partnering for Green Growth and the Global Goals): “It is imperative to develop institutions to encourage the support and engagement of all stakeholders, particularly the business community and the people. It is indeed crucial to promote public-private partnership (PPP) projects for green growth and establish new value chains and sectors through “greening” industrial and agricultural production, and services”[14]

———————————————————

Appendix 1: Approach to Global potential demand for voluntary carbon credit

Figure 15: Estimated potential demand in 2030 (source: TSVCM[15])

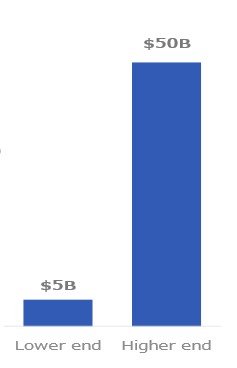

The 2030 potential demand has been calculated by the Taskforce for Scaling Voluntary Carbon Markets (TSVCM) with a range from $5 billion to over $50 billion. The potential volume and price based on 2 different scenarios for each (the lower bound and the upper bound).

In the lower bound scenario, the demand estimated by experts from TSVCM’s survey of 1 GtCO2/year while the price could be from $5-$15 per tCO2. In the upper bound scenario, the volume is the number of GtCO2 forecasted by The Network for Greening the Financial System (NGFS) climate scenario to achieve the 1.5°C pathway, which equal to approximately 2 GtCO2/year; and the price could be from $50-$90 per tCO2.

To arrive at these numbers, TSVCM assumes that all residual emissions, after all avoidance approaches have been taken, will be balanced out through carbon credits. The potential prices are calculated using TSVCM’s self-developed models.

Figure 16: Estimated potential demand in 2050 (source: BNEF[16])

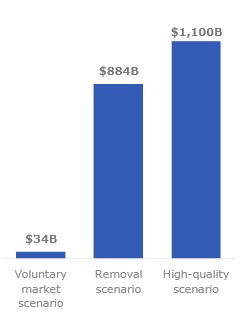

The 2050 potential demand is calculated by BloombergNEF’s and published in its “Long-term Carbon Offsets Outlook 2024” report with a range from $34 billion to over $1 trillion. The potential demand is valued based on 3 scenarios combining each volume scenario with the respective price scenario.

The 2050 potential demand is calculated by BloombergNEF’s and published in its “Long-term Carbon Offsets Outlook 2024” report with a range from $34 billion to over $1 trillion. The potential demand is valued based on 3 scenarios combining each volume scenario with the respective price scenario.

The potential volume could be from 2.5 billion to 5.9 billion offsets. In the Elastic demand scenario, volume is as low as 2 billion offsets due to oversupply and lack of trust in carbon credits’ quality. In the least-cost decarbonization scenario where integrity issues have been solved, and carbon offsets become a viable substitute to other forms of abatement depending purely on cost, the volume could be 5.1 billion offsets. In the inelastic demand scenario where trust issues have been solved and carbon credits become a critical part of companies’ decarbonization strategies, the volume could be up to 5.9 billion offsets.

The potential price could be from $14/ton to $238/ton. In Voluntary market scenario, where integrity issues are not resolved and the demand is elastic, the price could be as low as $14/ton. In Removal scenario, companies follow the least-cost decarbonization approach and can only buy carbon removals, which will raise the price up to $172/ton. In High-quality scenario, companies’ demand is inelastic, and carbon offsets come from advanced technologies, the price could reach $238/ton.

———————————————————

Appendix 2: Approach to Viet Nam potential market size for voluntary carbon credit

Figure 17: TAM of carbon credit in Vietnam potentially reaches up ~$1.2B, equivalent to ~150M reduced tons of CO2 emission in 2030, mostly comes from forestry and RE

For calculating the potential market size of carbon credit in Vietnam, there are two key points DI applies to better ensure the accuracy of our methodology:

We separate into 2 scenarios for a better estimation on volume of the market: (1) scenario 1 is the baseline, which is the NDC of Vietnamese government globally; (2) scenario 2 is the ideal situation, with expectation of strong international collaboration towards net-zero.

Vietnam has 2 main sources for CO2 reduction, with volatile price on each:

- (1) For forestry, we take the national forestry planning, and

- (2) For renewable energy, we calculate based on the number of tons of reduced CO2 if Vietnam can gradually shift from non-RE power generation to RE power generation, and then

- Agriculture is an emerging source for Vietnam, as the gov. is still studying and piloting on this. However, we still include in our calculation, as it is one major project applied on national scale with strong support from international org. We calculate the number of reduced tons CO2 per ha in 2030 if the project succeeds, and

______________________________________________________________________________________

About the Authors

Global SX practice

To learn more about Dream Incubator’s specialized expertise and capabilities related to global impact practice, or for additional information about this report, please contact:

Makoto MIYAUCHI

Tokyo

miyauchi.makoto@dreamincubator.co.jp

Andy Tuan-Anh NGUYEN

Ho Chi Minh

nguyen.tuananh@dreamincubator.com.vn

Aki MITSUBOSHI

Jakarta

mitsuboshi.aki@dreamincubator.co.jp

Research and analysis

Tram-Anh HOANG, Thu-Thao DO, Khanh-Chi NGO, Phuong Anh NGUYEN

______________________________________________________________________________________

[1] Vietnam Country Climate Change and Development Report:

https://documents1.worldbank.org/curated/en/099000007072236813/pdf/P177241053ba0a05a0811809c0

a36a856da.pdf (page 18)

[2] ADB Institute’s newsletter No. 2024-7 (May) Carbon Pricing for Green Transition https://www.adb.org/sites/default/files/publication/970731/adbi-carbon-pricing-green-transition.pdf

[3] Overview of the Joint Crediting Mechanism (JCM) https://gec.jp/jcm/about/

[4] IGES Joint Crediting Mechanism (JCM) Database

https://www.iges.or.jp/en/pub/iges-joint-crediting-mechanism-jcm-database/en

[5] Vietnam Business Forum of Vietnam Chamber of Commerce and Industry (VCCI) https://vccinews.com/news/51393/viet-nam-earns-us-51-5mn-from-first-forest-carbon-credit-sale.html

[6] Appendix 1: Approach to Global potential demand for voluntary carbon credit

[7] Nhịp sống kinh tế Việt Nam & Thế giới (vneconomy.vn)

[8] Appendix 2: Approach to Viet Nam potential market size for voluntary carbon credit

[9] Ai Leon, Taro Izumi, Impact of alternate wetting and drying on rice farmers’ profits and life cycle GHG emissions in An Giang Province in Vietnam, Journal of Cleaner Production, Volume 354, 2022

[10] Proximo https://www.proximoinfra.com/articles/8105/proximo-weekly-direct-air-capture-direct-to-market

[11] Vietnam+ (VietnamPlus)

[12] Vietnam Embassy in Japan

[13] Vietnam Investment Review

[14] baochinhphu.vn

https://en.baochinhphu.vn/full-remarks-by-pm-pham-minh-chinh-at-2021-p4g-seoul-summit-11141305.htm

[15] https://www.iif.com/Portals/1/Files/TSVCM_Report.pdf

[16] https://about.bnef.com/blog/carbon-credits-face-biggest-test-yet-could-reach-238-ton-in-2050-according-to-bloombergnef-report/

[17] Vietnam Business Forum of Vietnam Chamber of Commerce and Industry (VCCI)-Economy (vccinews.com)

[18] Việt Nam capable of earning revenue from carbon credit trade (vietnamnews.vn)

[20] Voluntary Carbon Credit Buyers Willing to Pay More for Quality (carboncredits.com)

[21] https://wtocenter.vn/tin-tuc/24524-vietnamese-farmers-welcome-low-carbon-farming-methods

[22] https://daklak.gov.vn/web/english/-/dak-lak-rice-farmers-have-the-opportunity-to-increase-income-by-selling-carbon-credits